freely floating exchange rates

Exchange rates: The value at which one countries currency can be exchanged with for a foreign countries currency.

Speculators: are people who analyze and forecast future price movement trading in order to get a profit.

Freely floating exchange rate: This is an exchange rate where the value of the currency is determined by market forces (factors affecting demand and supply) within the foreign exchange market

Currency appreciation vs depreciation

Currency appreciation: increase in the value of the currency in the floating exchange rate system.

Currency depreciation: decrease in the value of the currency in the floating exchange rate system.

Determination of exchange rates

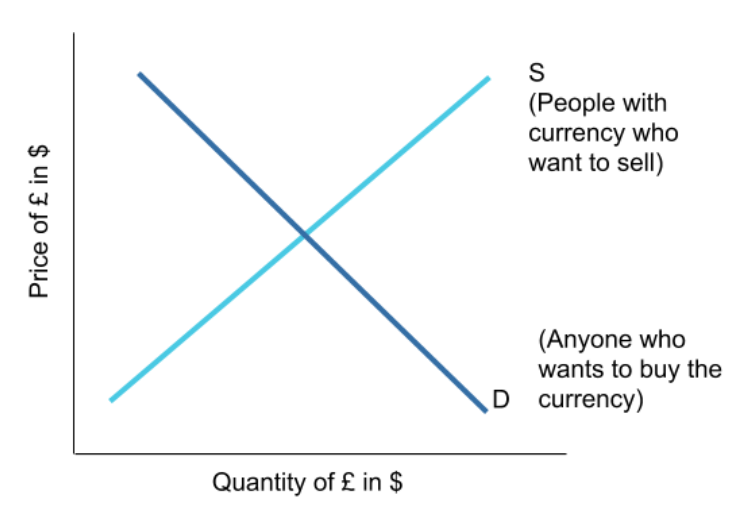

The exchange rate is determined by people by peoples demand for the currency and the supply of the currency. This is quite similar to how price was determined in macroeconomics, and to illustrate it we use an a very similar diagram.

Who demands a countries currency?

- people overseas wanting to buy exports (they have to buy the currency to exchange the good)

- People overseas who want to invest in the country

- Speculators buying currency to get profits.

- Central banks (adjusting their foreign reserves by buying other countries currency)

Who supplies a countries currency?

- People in the country who want to buy imports (they have to sell the currency to exchange the good)

- People in the country who want to invest overseas

- Speculators

- Central banks

Note: this is the opposite of what demand was

Causes of changes in exchange rate

The exchange rate is affected by changes in demand and supply of the currency.

- If demand increases the exchange rate goes up, if it decreases the exchange rate goes down

- If supply increases the exchange rate goes down, if it decreases the exchange rate goes up

Factors affecting exchange rate

- Interest rates: Higher interest rates make the country more attractive for investor which increases demand in the currency

- Inflation: Inflation makes exports less competitive so demand for currency decreases. It also makes import cheaper so supply of currency increases. Quantity traded stays the same and exchange rate falls.

- Trade: if there are more imports than exports the currency will be selling more their currency than buying. So exchange rate falls.

- Government policy: increase in foreign reserve, requires increase in supply of currency to buy foreign currency.

- Speculation: Speculators sell currency when they think it will fall and buy it when they think it will rise. This changes demand and supply of the currency.

Example - "The US increases their reserve of euros"

- The us increases their reserve buy selling their currency in return for the Euro.

- This increases supply of their currency

- This shifts the supply curve right, decreasing the exchange rate.

Economic consequences of exchange rate

- Inflation rate: If a country relies on imports e.g raw material imports then a decreasing exchange rate will cause these imports will become more expensive and prices will rise, increasing inflation. If they rely on exports, then these will become more competitive and demand pull inflation will cause prices to rise

- Employment: If exchange rate increases, exports become more expensive and thus less competitive. This decreases aggregate demand which leads to employment

- Economic growth: Decreasing exchange rate decreases exports and thus there is higher aggregate demand. This will cause the economy to grow. However the decreasing currency may be the cause of poor economic speculation causing people to sell the currency, thus negating the growth.

- Current account balance: If exchange rate increases, then it will change the current account balance because exports and imports change.

Government intervention

Fixed exchange rates

A fixed exchange is when the government pegs the currency to the exchange rate of other countries exchange rate. Often the exchange rate chosen is the countries main competitor, thus many countries choose to peg to the USD.

Maintaining a fixed exchange rate.

The exchange is connected to the demand and supply for the countries currency, so the country must buy and sell currency in order to affect the exchange rate. This can be done through:

- Central bank buying and selling foreign reserves

- Change interest rates. (Higher interest rates increase demand, lower decreases demand.)

- Controlling the exchange of currency. (E.g control exports and imports with subsidies, quotas, tariffs.)

Devaluation vs Revaluation

Devaluation: When a countries currency is lowered relative to another countries currency.

Revaluation: When a countries currency is raised relative to another countries currency

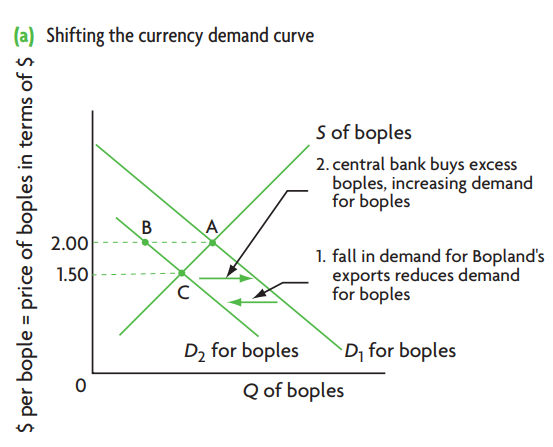

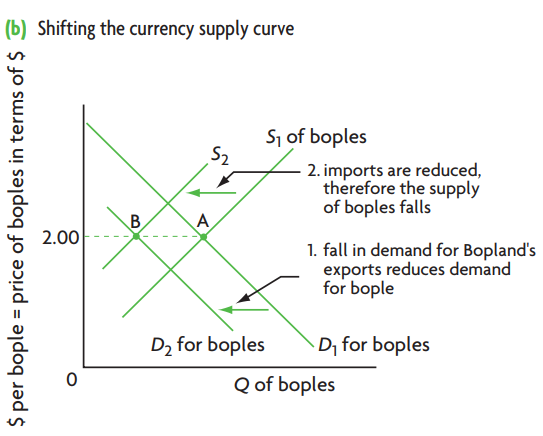

Showing how the exchange rate can be maintained in diagrams

In the diagrams above the bople is maintained at 2$ per bople. Importantly in the diagram a shift is shown which goes against the aim of maintaining the fixed rate and then a second shift is shown which fixes the problem.

Managed exchange rates

This is where the floating exchange rate still exists however there is a periodic government intervention to influence the exchange rate for various reasons. This allows the government to:

- Reduce current account deficit.

- Reduce risk of inflationary recession.

- Decrease domestic consumption and encourage exports and investment.

- Reduce government debt by selling overseas to countries.

Comparison and evaluation of fixed and floating exchange rate systems

View count: 16252